Your Home Could Be Worth 2x Its Value, Will It Last?

[ad_1]

If you’re American and own a house, you just got a whole lot richer.

The US housing market is skyrocketing right now, and is the highest it’s ever been since 2005, with 2.5 trillion in value. Experts say that we’re experiencing the strongest housing market we’ve seen in 30 years.

How are we amidst the largest housing boom ever? Let’s take a look at the trends.

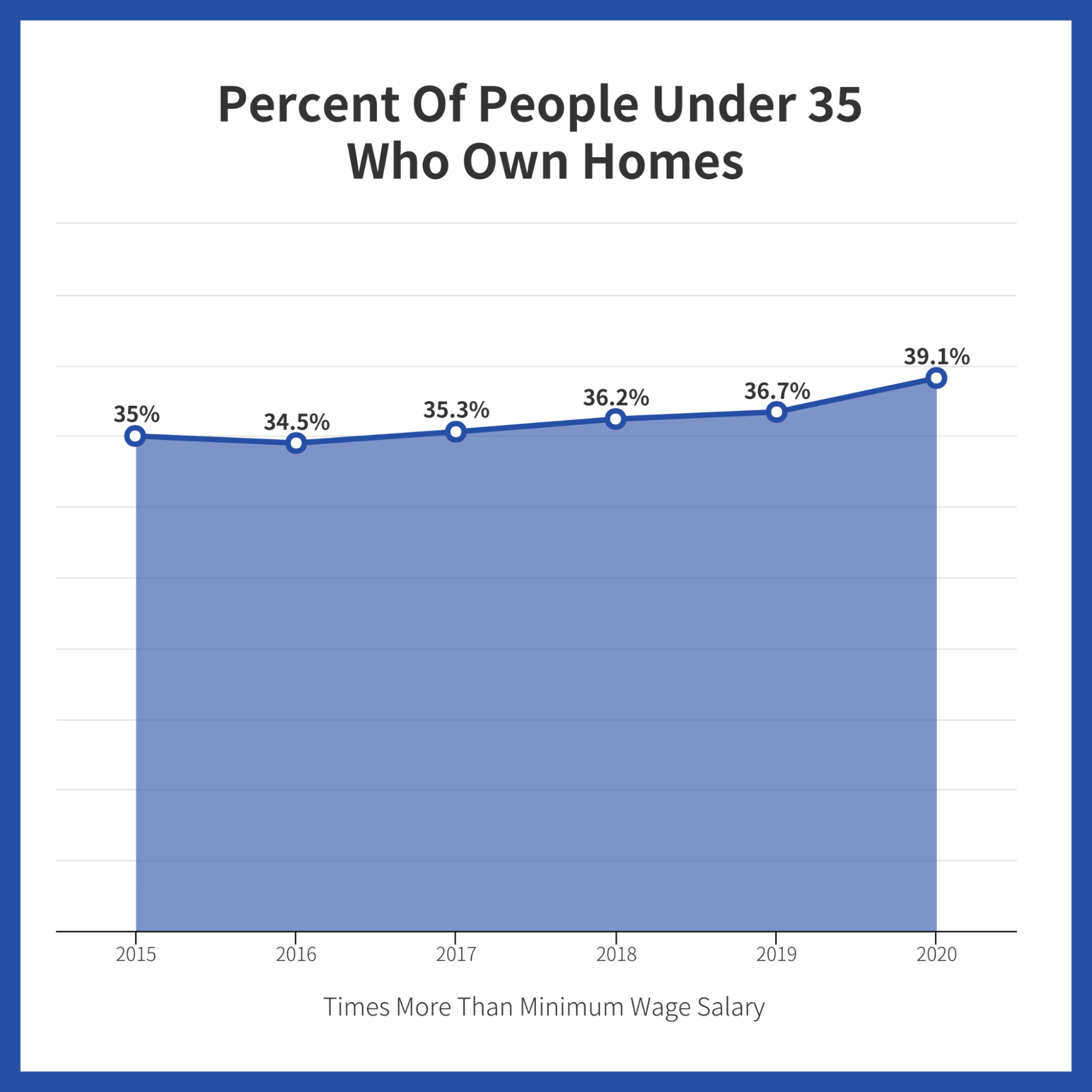

Millennial home ownership was at an all time low

Between 2006 and 2009, the average home lost over a quarter of its value. Millennials were only starting to enter the post-grad real life world.

The real world hit them hard with the 2008 economic crisis, and shattered a lot of dreams and goals for finding stable jobs, owning homes, providing for their growing families. More than eight million Americans lost their homes.

Millennials had a rough foray into the real estate market, and couldn’t even afford to save a couple thousands alone, not to mention for a house.

The market comeback in 2020

After 10 years of economic turmoil, the housing market is growing faster than ever. And many people think this growth will continue for the foreseeable future.

Experts are projecting growth of 23% in total homes sold since 2019, and 16% year over year in 2021.

America’s largest homebuilders say that over 40% of their buyers are under 34. After years of not being able to afford a home, Millennials are taking their time back and buying million-dollar homes just because they finally can. You can say they’re making up for lost time.

With almost 40% of people under 35 owning a home, that share of that age group has grown 8% in a single year. And is up 14% since it’s low point in 2016.

But it’s also a new generation of young Millennials that’s taking over the market! The average first-time home buyer is 31, and the average millennial only turned 31 last year. This means that it’s only the beginning for young homebuyers leaving their mark on the market.

Fewer homes leads to high demand

Americans weren’t able to buy homes after the 2008 crisis, but they weren’t the only ones in a loss for an investment. Home builders weren’t producing as many homes in that time period. As a direct result of this, there are fewer homes available for sale.

Right now there’s less than one million homes available in the US—the lowest number since 1982. And it’s not even hit peak home selling season.

Houses are also selling for more than ever, with 42% of all houses being sold above their initial price.

That’s the highest percent it’s been in 5 or more years, with a 16% jump year over year in total sales above list price.

And because of this high demand and low supply, the housing market will continue to rise up more than ever before.

Sources

[ad_2]

Source link

![6 Steps to Create a Strategic HR Plan [With Templates] 6 Steps to Create a Strategic HR Plan [With Templates]](https://venngage-wordpress.s3.amazonaws.com/uploads/2022/08/3e611956-2d22-469e-bbea-a3d041d7d385-1-1-1.png)