Trade Cryptocurrency For Short-Term Profit

[ad_1]

Financial Trading is a fantasy career for thousands of people around the world. The dream of financial independence. The challenge to outsmart the market. But are the odds of success any better with cryptocurrency compared to traditional financial trading with shares, precious metals, or forex? Let’s explore.

This guide will help you navigate the exciting yet risky opportunity of trading cryptocurrency.

Written by a crypto insider with 5-years experience trading crypto plus 12-years trading stocks and options, you’ll discover key principles and hard earned lessons to help you approach trading with the right mindset.

Our goal is to give you a sensible perspective about crypto trading that most traders only learn after months… or even years of trial, error and loss.

First things first: Trading is not a consistent, or even reliable way to make money. In fact, the general statistics for all financial traders is that ‘most traders end up losing money’ — despite what trading platform advertisers would lead you to believe.

Still keen to explore?

Ok. Here comes the disclaimer. This guide does not provide any financial advice. Trading is entirely at your own risk. This guide is provided for educational purposes only. We hope it helps you manage the risks and make better choices if you do decide to trade cryptocurrency.

3 Keys to Crypto Trading

Crypto trading means buying and selling digital assets (tokens, coins, ‘cryptos’) such as those you’ll find listed on our Cryptocurrency Prices page.

Different to ‘investing’, a traders mentality is shorter-term. Aiming to ‘get in and get out’ with a profit rather than waiting for the long-term that investors typically aim for.

Since most people lose money trading, how do the minority actually end up turning a profit?

There are 3 keys to trading:

- Fundamental Analysis considers the ‘fundamentals’ of a company or project, including its product vision, its existing customer base, quality of the team, partnerships, current revenue, etc.

- Technical Analysis focuses on the price chart using various indicators to make future price predictions based on historical price patterns. This is the main focus of most trading.

- Psychological Game is about developing the right patience, discipline and trading methods to reduce risk. This is the most important element of trading strategy.

In this guide, the first in a new series on crypto trading, we’ll focus on the psychological game with a big perspective on the market, some tips on fundamental analysis, and a quick intro to ‘technicals’.

The essential questions of trading reduce to this:

- What to buy?

- How much to buy?

- When to buy?

- When to sell?

Coins go up and down in value based on market perception about their value. That perception is a mixture of traders looking at the patterns of the price chart (technical analysis) and other market participants watching the news for project updates (fundamental analysis).

Successful projects (or at least those with the best marketing) will see greater interest in their tokens, leading to buyers paying a higher price for coins, which pushes the value of the token higher.

Choosing what to buy and when depends on a great deal of research, and some might say ‘lucky timing’ based on the cycle of the market.

The Boom/Bust Market Cycle

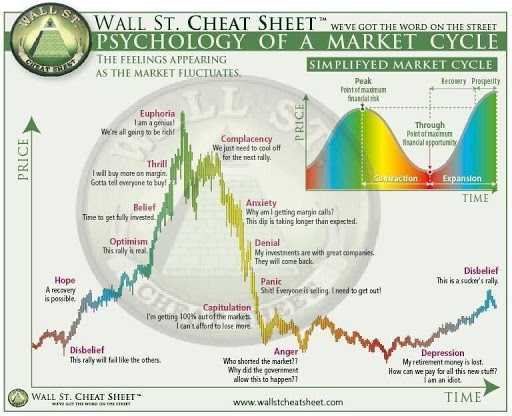

One of the most popular ideas in the crypto space is the ‘boom and bust’ market cycle, described by the ‘Wall Street Cheat Sheet’ as shown:

The idea presented here is that markets repeat somewhat predictable trends:

- Bull trend (prices going up and up where hope turns to optimism which becomes belief and then thrill and finally euphoria as prices reach astronomic levels…) leading to the start of a major…

- Bear trend (where prices begin to drop and investors are complacent to sell as they think the upwards movement will continue, but then anxiety sets in as prices continue to decline, leading to denial, then panic, anger and depression)… which finally results in the start of new hope as the next bull cycle begins.

Memes have been created out of this concept, with this one particularly amusing…. or painful…

REKT signifies being ‘wrecked’, like a ship wreck.

A full market cycle from boom to bust can take many months or even years.

The top of the previous boom for cryptocurrency was January 2018 when bitcoin reached a price of $17.000.

The bottom of the bust was December 2018 with a low bitcoin price of around $2.700.

Visit our Bitcoin price page to see the current price chart for BTC.

Since then, the phase of ‘disbelief’ gradually turned back towards ‘hope’ as a new possible boom cycle began.

What is usually not understood is that this pattern is essentially a fractal, which means it repeats across all time-frames. Tiny boom bust cycles within medium boom bust cycles within big boom bust cycles.

They don’t always show the exact same pattern, but the principle is there to be seen.

This allows the discerning trader to spot cycles at different time frames (hourly, daily, weekly, monthly) and then take advantage at the right moment by timing entry and exit positions accordingly…

The danger however, is getting drawn into the day to day, hour to hour, even minute to minute volatility of the markets, leading newbie traders to ‘over trade’ based on the heat of the moment…

Avoid Emotional Trading

Learning technical and fundamental analysis certainly takes some time. But it’s not the most difficult part of trading. The toughest job that traders have is managing their own emotion and being disciplined enough to follow their own chosen strategy.

All traders struggle with emotional trading. The temptation to trade is almost overwhelming. We can see so much profit potential. Coins jumping 5% here, 8% there. Then dropping back down again. If only we could capture those frequent % moves!

Analysing trades requires a ton of discipline. Most people see some hype about a particular stock or a crypto coin, they see the price is already starting to shoot up and they don’t want to get left behind, so they buy too much at once (often called FOMO: Fear Of Missing Out).. and then … yes, the market cycle reverses and prices start to tumble… and the person either sweats with anxiety until their hopeful position recovers and enters profit again, or they sell for a loss.

This is emotion-based trading. It is common. It is not a good strategy.

Key to successful trading is to remove the natural emotion of hope, greed, panic, guilt and excitement. Traders are not meant to be gamblers. They are meant to be strategic, objective, rational planners.

Pump and Dump Schemes

Unfortunately, unscrupulous individuals or groups attempt to take advantage of the excitement and greed of trading by rallying buyers to invest in a particular crypto which does not have very much trading volume.

This causes a surge in the tokens price, at which point the scammers will sell their own tokens raking in lots of profit, while the other investors are then left holding coins they bought at a high price, while watching the price tumble back down, based on lack of genuine market interest.

This is known as a ‘pump and dump scheme’.

To avoid these schemes, consider the trading volume of the coins you are interested to invest or trade, and avoid the temptation of FOMO. That Fear Of Missing Out indicates when investors buy because they see the price running higher and higher and don’t want to ‘miss out’ on the hot opportunity.

Technical Analysis — An Easy Way To Start

In future guides we’ll explore the intricate details of technical analysis. To get started, a good approach that new traders can make use of is to look for market correlations by comparing price charts for different coins.

For example, check to see if the coin you want to trade is positively or negatively correlated with bitcoin. That is, if it tends to move in a similar direction as bitcoin or not, on the time-frame that you want to trade at.

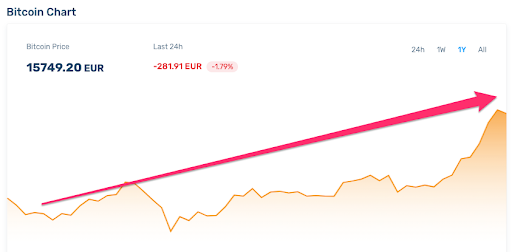

Here’s the price chart for bitcoin (BTC) showing 1 year worth of data:

Here’s the price chart for Propy (PRO) showing 1 year of data.

As you can see, the price of Propy has been volatile over the past year, but at the time of writing, the price is near enough at the same level that it was a full year ago. From that perspective, holding bitcoin during the same period of time would have been much more profitable. Unless you bought at the low point and benefited from that sudden spike upwards (as indicated by the green arrow).

This type of analysis may help you decide whether to keep more of your portfolio in BTC vs other coins, which may either be gaining value compared to bitcoin or losing value compared to bitcoin.

Having a diversified portfolio is both sensible, and typically shows the best performance in the long run.

Fundamental Analysis

To help you explore the details of each coin project, we are working with researchers, market analysts, and representatives from crypto projects, to develop resource guides for each coin that Kriptomat makes available on our exchange.

Visit the cryptocurrency prices page and click on any coin to explore each project’s fundamentals.

Continue Learning

Kriptomat account owners will have access to regular trading tips and analysis. Register for a Kriptomat account and you’ll be notified when new trading information becomes available.

[ad_2]

Source link